calsfoundation@cals.org

German National Bank

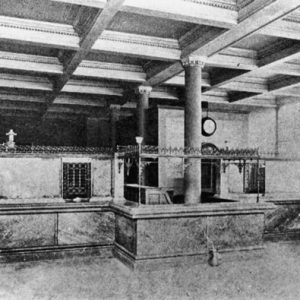

From its opening in 1875 to its closing in 1930, the German National Bank (under a variety of names) was considered a financial pillar of Little Rock (Pulaski County) and central Arkansas. Saluted by the Arkansas Gazette as the “leading bank of the state” in 1876, it grew to become the largest bank in the state, largely through bank consolidations in the first quarter of the twentieth century.

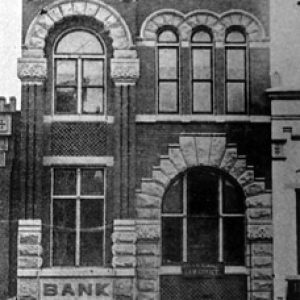

In early 1875, the German Savings Bank was organized by Charles Penzel. A prominent financier, Penzel came to the United States from Bohemia in 1857 and served as the bank’s first president. The business and fixtures of the bank were purchased from George Brodie and Sons, which had gone out of business in 1874. The bank opened at the corner of Main and Markham streets in Little Rock with capital of $50,000. Soon after, this increased to $75,000, and the word “savings” was dropped from the bank’s name.

While many of the early investors were of German descent, the bank did not serve only the German-American community. The name was chosen to distinguish the bank from other local banking outfits, largely because Germans were perceived in Arkansas in the late nineteenth century as thrifty, dependable, and trustworthy in financial matters. The Gazette reported in 1884 that the bank had capital of $250,000, a list of clients that consisted almost entirely of merchants, and financial correspondence with many countries including England, France, Germany, Spain, Italy, Russia, Turkey, Australia, Egypt, and several in Asia.

In 1883, the president of the German Bank was Daniel G. Fones, who was followed by Colonel John G. Fletcher in 1885. The name of the institution was changed to the German National Bank in March of that year to reflect its status as more than a local institution. Fletcher served as president until 1906. In 1888, the bank’s original clerk, Creed T. Walker, resigned and was replaced by Oscar Davis. Davis and other cashiers sent out letters to the banks of the state requesting that those who favored the organization of a banking association permit the use of their names to call a meeting for that purpose. On October 21, 1891, the Arkansas Bankers’ Association (ABA) was formed. Still in operation today, the ABA is Arkansas’s oldest and largest banking organization.

In 1907, the German National Bank sued the Arkansas Southern Railroad Company to recover the value of 999 bales of cotton that were never delivered. A shipping error had caused railroad workers in El Dorado (Union County) to believe the cotton was owned by the Alpine and Lake Cotton Co. and had used the cotton as security on their debts to the bank. The cotton was never recovered, and the railroad company was ordered by the court to reimburse the German National Bank for its losses. Many felt this decision was unfair to the railroad company, and they appealed to the Arkansas Supreme Court. The court ruled that though the railroad was not responsible for the costs of storing the cotton in El Dorado, it was responsible for failing to deliver the cotton to the proper place. This case marked an early example of common law trials that held the carrier responsible for the delivery of goods.

The American Bank merged with the German National Bank in 1911. The German Trust Company was also formed at this time and operated independently of the bank. During this time, John M. Davis served as cashier at the bank. Davis later became Arkansas’s first banking commissioner.

During World War I, the German National Bank and the German Trust Company changed their names to the American National Bank and American Trust Company in response to anti-German sentiment caused by the war. In 1919, both the bank and the trust merged with the Bank of Commerce to form the American Bank of Commerce and Trust Company. Each merger gave the institution a larger share of the financial market of Arkansas. Edward Cornish (husband of birth control advocate Hilda Cornish) served as the first vice president and second president of the bank.

In 1924, the bank was once again consolidated into a larger company, as the American National Bank and the Southern Trust Company of Aloysius Burton (A. B.) Banks merged to form the American Southern Trust Company. A. B. Banks controlled many smaller banks around the state, and this merger formed a banking company that was central to Arkansas’s financial life. The American Southern Trust Company (which later shortened its name to the Arkansas Exchange Trust) soon became the largest bank in Arkansas, but it collapsed in 1930, setting off a string of bank failures that brought down sixty-six other banks around the state. The collapse was caused by the failure of the Nashville, Tennessee investment banking firm Caldwell and Company, in which A. B. Banks was heavily involved; he was later prosecuted for his role in the bank failure but received a pardon from Governor Harvey Parnell.

For additional information:

“Business & Finance: Still Solid South.” Time, December 1, 1930. Online at http://content.time.com/time/subscriber/article/0,33009,930704,00.html (accessed March 8, 2022).

Germain, Richard. “Were Banks Marketing Themselves Well from a Segmentation Perspective before the Emergence of Scientific Inquiry on Services Marketing?” Journal of Services Marketing 14.1 (2000): 44.

Supreme and Appellate Courts of Arkansas. “Arkansas Southern Railroad Company v. German National Bank.” Southwestern Reporter 92 (1906): 522.

Worthen, W. B. Early Banking in Arkansas. Little Rock: Democrat Printing Co., 1906.

Catherine Henderson

Ward, Arkansas

Staff of the Encyclopedia of Arkansas History & Culture

Business, Commerce, and Industry

Business, Commerce, and Industry American Bank of Commerce and Trust

American Bank of Commerce and Trust  Bank of Commerce

Bank of Commerce  German National Bank

German National Bank

Comments

No comments on this entry yet.